Before We Start…

Airline Relief Is Welcome –

But Is It More of A New Gas Cap In An Emerging Tesla World?

The relief funding for airlines is great news… over 30,000 employees with at least their income restored, and airlines adding back service (as required by the legislation) to points which were dropped since the last relief funding expired in October.

The only fly in the ointment is that all this can vaporize after March when the funding expires.

It’s near certain that some of the airports that have received reverse-pink slips in the past two weeks will ultimately retain the service after the expiration of the relief. But not all.

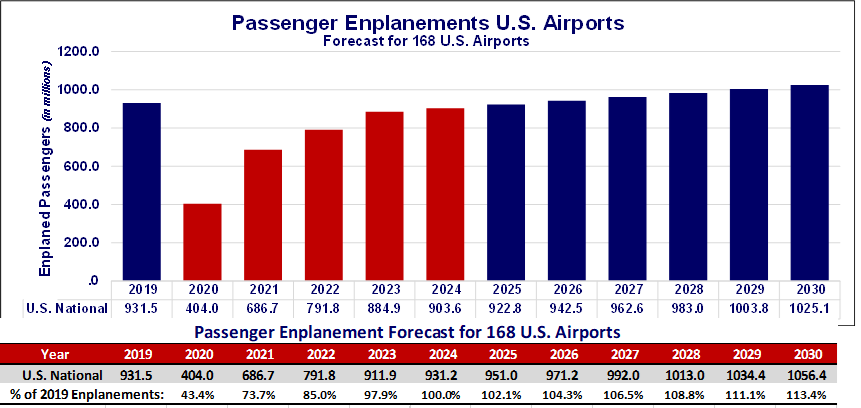

Where the uncertainty is found is in the consumer and economic shifts in the basic structure of the air transportation system. Currently, the goal seems to be restoring the air transportation system to its pre-2020 structure.

Where the uncertainty is found is in the consumer and economic shifts in the basic structure of the air transportation system. Currently, the goal seems to be restoring the air transportation system to its pre-2020 structure.

That, unfortunately, is a near-impossible objective. The economic system on which the industry was dependent has changed fundamentally.

Point: the relief is positive. But it does not address the future changes that will be necessary in the coming year. We touch on this below,

______________

New Metric: Traffic Composition Replaces Traffic Volume

Get with it. We’re not going back to 2019.

There is no longer any question that the role of air transportation as a communication modality has now been changed completely due to the economic damage done by the China-CCP pandemic.

Airports and aviation-related businesses need to recognize this – and start to plan accordingly, NOW.

It’s basic, unshakable economics: When the utility and veracity of any product declines, the core consumer demand will decline and take a new role in the marketplace.

This is exactly what has happened with air transportation.

Its utility has been materially changed by the acceleration of the trend toward electronic means of communication. This has been a trend for the past 25 years, as demonstrated by the increasing economic obsolescence of short-haul air service. But with the forced lock-downs across the country in the past year, the stampede away from business air travel to virtual communication has gone into warp speed.

As a modality for business communication, some sources estimate as much as a 20% decline… which may be accurate. But the impact will be registered based on the mix of business v leisure travel in each region and each airport.

What to watch for in 2021 as a result of this shift:

Short-haul business markets will continue to atrophy.

This will likely be most severe in markets that were already declining, such the WAS-NYC-BOS corridor.

It will likely also be experienced in former strong business/commuter markets like PHL-PIT, and any point-to-point segment where the travel time for a day trip (total time, not just the time sitting in 13A breathing through one’s increasingly uncomfortable mask) is more than 4 hours.

That’s a rough estimate, but do the math when it’s a three-hour meeting or less. The immediate interaction via a modality that admittedly still looks like a hostage video is a lot more cost-effective and vastly more time-effective.

Even some west coast markets that were previously less affected by the electronic dragon, such as the LAX – SFO area markets and any short haul intra-regional routes involving declining city battlegrounds such as PDX and SEA will likely see major declines.

Leisure traffic less affected. It’s less sensitive to travel time.

Getting to Boca to see the family usually is a much less time-centric process than having to be at a 10:30 meeting in Chicago.

Therefore, we will continue to see domestic and near-domestic (such as Caribbean) experience some recovery. And there will be more airline planning focus on shifting capacity into such markets.

But do not tumble to the concept that this will replace the decline in business traffic, either in volume or in revenue.

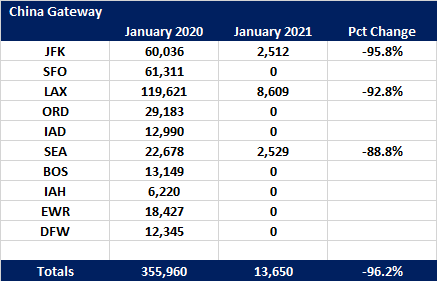

International demand is kaput for the rest of the year… maybe longer

This is more of a hit than it may appear. The airport enplanements driven by international traffic flows – direct and indirect – represented about 31% of the total U.S. airport traffic. Very uneven across the nation, but still near a third of our traffic. We can safely project that this will be slashed at least in half.

Nobody is planning a magic vacation to the lake country of Italy this year. One cannot do business in the U.K. when it gets closed from time to time. Doing an unexpected 14-day quarantine on arrival at a foreign destination is not what a family of four is hankerin’ to do.

Australia is not only fundamentally cut off from the air service world, but even domestic travel between states is restricted. Want to go to northern Ontario for a fishing trip? This year, phone it in. The trout get to relax. The border is essentially closed.

It’s Traffic Composition, Not Traffic Volume

In the coming year, the #1 challenge for the air transportation industry, including airports, will be accurately adjusting to the fallout from the shifts in the basic structure of the consumer base.

Give some thought to the levels of infrastructure and facilities at a given airport that will change due to the fundamental changes in the role of air travel in the economy.

At the terminal, what about the accommodation for black cars, which will be in less usage at many large airports. Then at smaller airports, keep in mind that those rental car counters were supported largely by business travelers. We’ve already seen some companies pull out of such airports.

That very appropriate business lounge the airport built will have less demand. Maybe at some larger airports, that major airline membership club might not be needed. How about any changes in the concession mix?

The point is this. Much of the planning that’s been in place for the last twenty years will be challenged with the new consumer mix. At Boyd Group International, we’re applying our industry-leading forecast expertise in assisting our clients to identify, adjust, and optimize these changes.

The point is this. Much of the planning that’s been in place for the last twenty years will be challenged with the new consumer mix. At Boyd Group International, we’re applying our industry-leading forecast expertise in assisting our clients to identify, adjust, and optimize these changes.

If you’re interested in pursuing a new-generation strategic plan for your airport, just hit the contact button, and we’ll set a time for a conversation regarding our Runway To The Future™ program, tailored to your airport.