Seven Trends That Will Affect Air Traffic In 2019

Looking at the New Year, BGI has identified Seven Key Trends that will have material effect on US air transportation…

One: The Threat To The Drone Revolution

Two: Airlines Now Much Less Affected By Outside “Studies”

Three: Northeast Airports In Line For Trans-Atlantic Service

Four: US Carriers To Reduce China Capacity

Five: The Iceland Hopscotch System To Europe Is Ending

Six: Cuba: Less Service… The Expectations Were Bogus

Seven: ULCCs To Be 15% of Capacity… But Where?

Let’s take a look:

The Drone Revolution: Time Is Running Out

The potential is incredible – particularly for the new economic role of rural airports.

But what’s also incredible is the fact that the FAA simply views it as just a bunch of small flying machines that are mostly interruptions of their day.

There are now thousands of un-tracked drones in use across the country, and the recent examples in the UK and China, where they were used to threaten operations, are just warnings.

It’s not just a matter of detecting these things. It is imperative that systems be found – now – to be able to identify the operator.

Unless the FAA gets off its keester and starts to take some proactive leadership in developing controls and monitoring of these devices, the chances of a nasty drone-airplane accident are going up by the day.

The FAA has no grasp of the importance of this new technology, and zero understanding of how to deal with the challenges it represents.

One accident… one near-miss… one terrorist use of a drone, and the clowns in Congress can be depended upon to use it to the utmost political advantage.

Point: the various sectors of the UAS industry need to continue to aggressively take these issues into their own hands… waiting for the FAA to do it is like leaving the light on for Jimmy Hoffa.

_____________________

Airline Planning – Increasingly Unilaterally-Generated.

In 2018, there was a marked change in airline route and market tactics.

It’s now clear that major carrier systems each have their own clear, set-in-stone route strategy. They’re not looking for outside advice – their plans are in the works already.

The imperative for airports in 2019 will shift from the outdated goal of “making the case” for a random new route, to accurately predicting, identifying and matching carriers’ evolving growth strategies.

That 60-page “true market study” may impress the mayor, but it’s no longer a Delphi-like revelation to airline staff. They have their own strategies… airports and communities must now identify and adjust to airline direction, not the other way around.

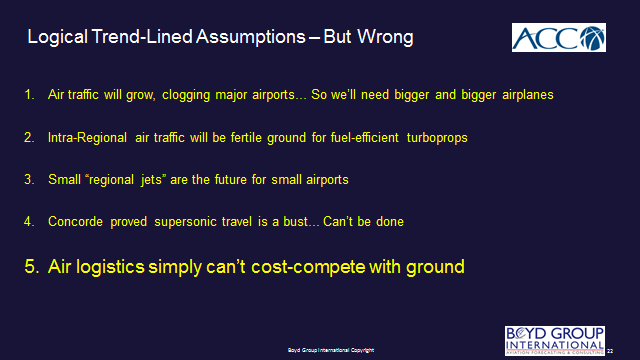

Market-Matching The Fleets. The key is to understand and anticipate how fleet shifts and aircraft utilization will drive market decisions.

A couple of examples. Take a look at United: they are adding A-319s coming off lease from carriers across the globe, but on the mainline side, they have very few portions of their fleet that are in line to be retired. Message: at some point, there will eventually be the specter of reduced dependence on outsourcing flying to other operators.

Delta is now pulling down the fleet of 717s they acquired from Southwest, and adding in A-220s, while also reducing both MD-90s and MD-88s. This does indicate a different set of route and market strategies – because the new fleets represent new market missions and market applications.

As for 50-seat jets, they gained a reprieve with lower fuel costs. But that’s still temporary… they will be phased out at some point in the future, and it will take place with not a lot of early warning.

In 2019, major fleet mix changes will identify airline strategies – and route planning – for the future.

Get Out of The “Study” Trap. In 2018, Boyd Group International was successful in assisting a range of airport clients in building new air service access, using this approach. If your community is interested in getting right to the chase in regard to crafting a futurist air access plan, give us a call, or click here for more information.

We know airline strategies – and, as demonstrated at our International Aviation Forecast Summits – airlines know us.

___________________

Expanding In 2019: Trans-Atlantic Flying

Boyd Group International was the first to outline the potential that large non-hubsite US airports represented to EU and UK carriers.

That’s now taking place.

The next phase – which BGI forecasted at the 23rd International Aviation Forecast Summit last August – is trans-Atlantic service from secondary US points along the US East Coast. The economic factors will be generated based on regional access to strong internationally-related business and industry.

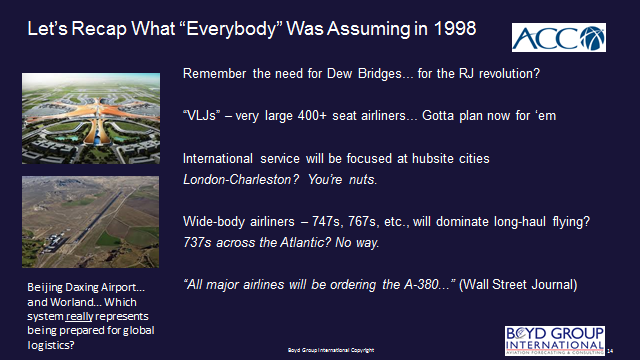

Charleston-London is just the first… and the metrics airlines use to determine these markets differ from traditional ones.

Road-Hubbing Airports In The Cross-Hairs. Here’s a hint on what to expect: draw a radius across the Atlantic from London based on the range of the new long-range A321Neo.

Take a look at the US airports that are covered. Then take a look at the interstate highway access they may have, and draw a 90-minute drive time from there, and compute the industrial base. That’s the raw starting point for developing and honing the true new trans-Atlantic catchment areas.

Using traditional metrics, there’s no way Charleston could support London service. But those metrics and that approach are now obsolete.

Point: there are about ten airports in the Northeast that may want to make sure their FIS is ready, and they have the political juice to get them staffed.

Get Your International Program Going. Boyd Group International’s Airports:USA® and Aviation DataMiner™ systems have the futurist analytical capability of determining approaches airports and regions can take to attract this new international dynamic.

Give us a call or e-mail, and we can discuss developing a community outreach and airline industry strategy for your region.

______________________

China: US Carriers May Need To Temporarily Retrench

Our forecast for US airlines: be ready to cut China capacity in 2019.

The local US originations are likely to fall precipitously in the second quarter of the year.

No, it’s not due to trade disputes.

It’s going to be driven by new policies by the Xi administration in Beijing intended to crack down on dissent, and which have resulted in the US State Department issuing a warning regarding travel to China.

“U.S. citizens may be detained without access to U.S. consular services or information about their alleged crime. U.S. citizens may be subjected to prolonged interrogations and extended detention for reasons related to “state security.” Security personnel may detain and/or deport U.S. citizens for sending private electronic messages critical of the Chinese government.”

This will have a chilling effect on visitation from the US, and that will hit US airlines harder than Chinese carriers. The chances of a US visitor to the Great Wall to get involved in any of this are pretty slim, but the implications are not such as to get folks to get enthusiastic.

BGI has been at the forefront of analyses of the booming Chinese air transportation system, and the huge potential for traffic from China to the US. We are the leader on China consulting for US airports and communities.

Chinese Visitors Will Keep Coming… But On Chinese Airlines. We previously were predicting over 25 million folks from China to visit the USA over the next five years. For the time being, that forecast stays in place. The demand from China, given implementation of nonstop flights from key cities to large US commercial centers, is still astronomical.

Just one example is Fuzhou-JFK. (Yes, Fuzhou – google it if you must.) Before Xiamen Airlines implemented nonstops, the total O&D between these cities was estimated at less than 3,500. In the first year of nonstops, Xiamen carried over 70,000 passengers – all O&D.

So, the curious projection is that China-originated US traffic will not be materially affected. But US airlines likely will see some downturn in the coming months.

_________________________

End of The “Iceland Option”

In 2019, we will likely see the end of the “Iceland-Option” – really low fares to Europe – in exchange for a stop in KEF.

Like with domestic ULCCs, the lure of super low fares as an alternative spending option for a trip to Europe looks great. But that concept also encompasses the need for the destinations to be well-accepted and desired.

Phoenix, Orlando, Punta Gorda… no problem. But for consumers in the US, going to places like Cork or Oslo at cheap fares, with a stop at an airport many can’t spell, let alone know of, hasn’t translated in the same way as an impulse trip to Epcot.

By the end of 2019 – most of the Iceland-US service to non-hubsite airports will be gone.

___________________-

Cuba: Move Along, Folks. Nothing Here.

Or, Not Much To Visit, Yet, For That Matter

In 2019, there will be more constriction of US-Cuba air service into the SE Florida – Havana corridor.

As has been forecasted in studies by BGI, Cuba “demand” is several galaxies away from the euphoric nonsense put out by the travel industry immediately after the “opening” of the market by Obama in 2014.

FedEx recently gave up on attempting cargo services, noting that they had difficulty in finding local partners to work with… not to mention the challenge of finding any cargo business, either.

Attempting air freight operations to Cuba is akin to shipping air conditioners to the burgeoning condo market in Antarctica.

Southwest recently dropped plans to add more Cuba flying out of Tampa, and American is tossing in the towel on CLT-HAV flights. Alaska, Frontier and Spirit have left the market.

Contrary to implications in some parts of the media, this has nothing to do with any revisions made in Cuba travel policy by the Trump administration.

The market will remain a dog until cleptocracy running the place opts for a new line of work someplace else. There is no business base in Cuba, and give-or-take a couple of high-profile hotel deals, the hospitality industry is somewhere still in the 16th century.

2019: The focus will be on SE Florida to Havana, and most of that will be VFR and adventure travel.

_______________________

ULCC Capacity: How Far Can Fare Stimulation Go?

Projection: ULCC capacity will grow to as much as 15% of all seats produced in the US by the end of 2020.

Other than a complete economic downturn, this may be conservative. However, this will not alter the need for a shift in economic planning from often-futile attempts at getting network service at small local airports, instead of wider, regional approaches.

In 2019, it will take a Ouija Board, a crystal ball, a gypsy séance and several e-mails from On High to predict where ULCC service will spike traffic, and which routes will see those spikes deflate as these carriers rapidly re-deploy assets.

But it won’t take much to understand that there will be enormous amounts of net-new air traffic generated by this genre… which now includes Sun Country, joining Spirit, Frontier and Allegiant.

A Short-Term & Long Term Forecast Tool Now Available. The challenge for airport planners is to attempt to project where and how these carriers will increase enplanements.

The Boyd Group International Airports:USA® program aggregates a wide range of near-term metrics at each US airport, including factors such as capacity shifts, load factor trends, fare level sensitivity, and other data, to produce our exclusive Short Term Enplanement Trend Forecasts, looking 12 – 14 months into the future.

Updated monthly, the program delivers a reasonable projection of traffic volatility, and then is the basis of the Airports:USA® ten year forecasts.

If you are not an Aviation DataMiner Subscriber, click here for more information on our short term and long term enplanement forecasts.

______________________

Airport Success Planning In The New Environment

Airport Success Planning In The New Environment

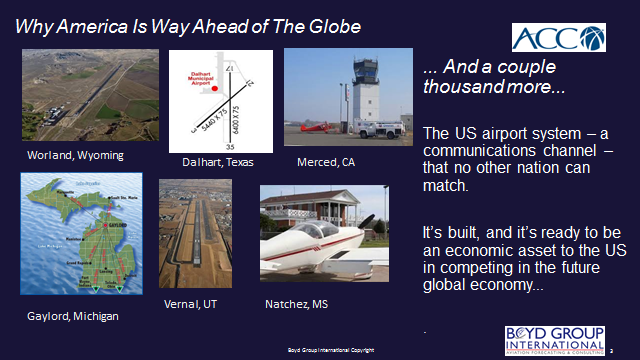

America, we are told by the newly-formed airport-design Peanut Gallery, is falling way behind. This is often accessorized by really stupid comments inferring that any small airport without scheduled passenger flights is on the edge of total failure.

America, we are told by the newly-formed airport-design Peanut Gallery, is falling way behind. This is often accessorized by really stupid comments inferring that any small airport without scheduled passenger flights is on the edge of total failure.

We’ve just made available our Summary report of the trends emerging as we come to the close of 2018.

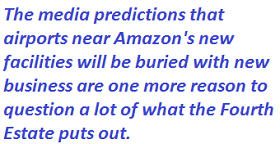

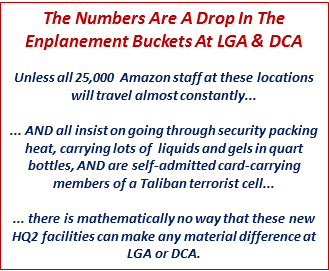

We’ve just made available our Summary report of the trends emerging as we come to the close of 2018. Yessir, there’s going to be a tsunami of new airline passenger traffic generated by the decision by Amazon to locate facilities in Queens and in Northern Virginia, promising to bring an additional 25,000 jobs to each region.

Yessir, there’s going to be a tsunami of new airline passenger traffic generated by the decision by Amazon to locate facilities in Queens and in Northern Virginia, promising to bring an additional 25,000 jobs to each region. Some will be from Queens, some from other Buroughs, and some from Long Island and elsewhere in the region. But most won’t be arriving in moving vans.

Some will be from Queens, some from other Buroughs, and some from Long Island and elsewhere in the region. But most won’t be arriving in moving vans. anything produced by Boeing or Airbus or Embraer.

anything produced by Boeing or Airbus or Embraer. Let’s not forget the planned Sino-Russian wide-body C929 that’s also a glimmer on the long term horizon. Or, maybe we should.

Let’s not forget the planned Sino-Russian wide-body C929 that’s also a glimmer on the long term horizon. Or, maybe we should.