Starting Out This Week…

Wait ‘Till Madison Avenue Gets Hold of This Account…

Coming from almost nothing, he expanded his market share by subjugating populations of entire countries. If the competition didn’t agree, he simply whacked them out of existence.

He was a master at building brand-identity… he gained great fame for imposing it from eastern Europe all the way to Korea.

He brooked no nonsense from his subordinates – or his competition, both of whom often ended up in some form of untimely, albeit usually innovative, demise or another.

He had outstanding inter-personal skills in dealing with differences of opinion. Heck, he and his generals once dined on a giant platform, designed specifically to settle slowly during the repast to squash into the next world several Russian princes who didn’t agree with him.

The man was a regular love machine.

Results were the only priority, even if it meant tossing whole kingdoms – and their subjects – into the dustbin of history. If his staff failed to deliver, they were history, too.

Results were the only priority, even if it meant tossing whole kingdoms – and their subjects – into the dustbin of history. If his staff failed to deliver, they were history, too.

So, with all this, he’s a natural guy to represent a modern airline.

That’s right, that famous paragon of warm customer service, Genghis Khan, will have his own airline next year, based in the China Autonomous Region of Inner Mongolia.

The advertising program should be a real hoot… “We plunder low fares…” or, “Our service terrifies the competition … and our customers, too…”

Or, the inflight announcements… “Put your seats and tray tables in the full and upright position…disobey, and you’ll be most regretful…”

They have 25 ARJ-21s on order.

And, as a regional touch, they’ll probably allow Mongolian war ponies as emotional support animals in the cabins, too.

___________________________

Main Focus This Week…

Charleston – London: The New Paradigm

Airports:USA Trend Forecasts Validated

Air Access Planning Has New Metrics

It’s not a sprawling metropolis. It has a population of less than one million.

It is not at the confluence of several Interstate highways. It has virtually no smokestack industries.

And shortly, British Airways will begin nonstop flights from there to London.

It’s Charleston, South Carolina, and the decision to start service across the Pond flies in the face of traditional airline route planning. Which is exactly the point. There are new air transportation dynamics in play – “tradition” is out.

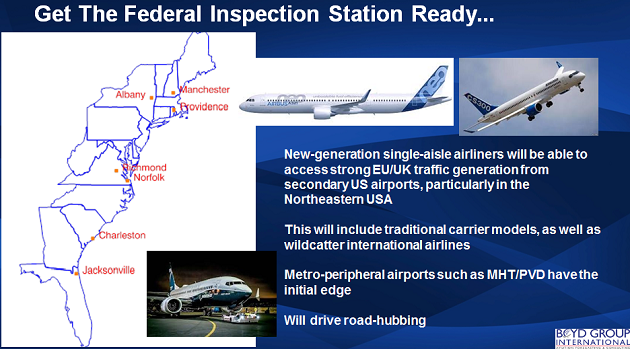

Global Economic Presence Now A Key Planning Metric. At the 23rd International Aviation Forecast Summit, August 19-21 in Denver, one of the forecast trend predictions was major UK/EU network carriers will be adding service to secondary non-hubsite airports on the Northeast and along the US East Coast.

We specifically and independently identified CHS as a prime target.

Boyd Group International’s Airports:USA forecast system is unique in that it goes way beyond historical data. It understands that global economic presence will now be a major determinant of where international network carriers decide to invest their aircraft resources.

Charleston – London, which is outside of any “traditional” market planning paradigms, is just one of the secondary cities the forecast identified.

Presented and discussed August 20th at the International Aviation Forecast Summit

Note: For clarity, BGI was not involved in the BA-CHS decision, nor with CHS. But the fact is that our forecast expertise independently identified the market opportunity, and it’s an example of the extensive research and global expertise we bring to our clients, from airports, to airlines, to financial institutions and more.

Identifying The New International Air Service Metrics. CHS is a poster child for the new future international air access metrics.

While its local population is comparatively small, that’s eclipsed by the global commercial make up of the Charleston region. It’s one of the largest and most efficient container-ship ports in the nation, and the growing presence of global-centric, high-tech industries such as Mercedes-Benz and Boeing, identified it in our forecasts as a key future feed point for European carriers.

While its local population is comparatively small, that’s eclipsed by the global commercial make up of the Charleston region. It’s one of the largest and most efficient container-ship ports in the nation, and the growing presence of global-centric, high-tech industries such as Mercedes-Benz and Boeing, identified it in our forecasts as a key future feed point for European carriers.

Apparently British Airways came to the same conclusion.

New Aircraft Capabilities Open New Trans-Atlantic Opportunities. Markets such as Charleston are near-textbook (the new textbook) targets for new-generation aircraft such as the A-321LR and the B-787.

Here’s a clue for folks still using past DOT data in futile attempts to forecast the future: new airliner capabilities will drive new airliner mission applications. Past traffic data are essentially just anecdotal – at best.

As the header on the slide suggests, the other six airports will be well advised to get their FIS ready with a facility plan and – importantly – a CBP staffing plan to quickly handle arrivals of 160 or more passengers from the Old World.

It’s Core Business Traffic. Fare-Stim Less of A Factor. This is not to be confused with route expansion by low-fare wildcatter carriers, such as WOW and Norwegian.

They are only after price-generated net-new traffic, while British, Lufthansa (and even the SkyTeam/Delta system) are interested in tapping the growing international business market for feed through their hubsites on the other side of the Atlantic. Now, with new-capability airliners like the A-321LR, the 787, and new iterations of the 737, airports like those in the slides above need to think about the future in a different context.

Interested In Moving Your Planning Into The Future… We’re Ready. To be sure, there are no guarantees, but the message is clear – again – that traditional “air service development” analyses that wallow out obsolete “PDEW” data – particularly international data from the BTS – are a great way to stay in the past.

BGI is the only consulting and forecast firm that isn’t afraid of questioning traditional data and traditional thinking. As the slide above shows, and our 30-plus year track record verifies, Boyd Group International isn’t reticent to question ambient thinking.

As examples of how our approach has assisted clients in exploring new international opportunities click on the link at the end of this Update. Look it over, and then hit the Contact Us button above, and let’s start discussing your new air service access plan.

Soon – On-Line Airport Traffic & Trend Forcasts.

The identification of secondary targets for trans-Atlantic exemplifies the forecast and predictive analysis capabilities of the team at Boyd Group International.

Not Just Numbers. Insight. We’re now completing and beta-testing the first on-line, predictive trend and enplanement forecasts, Airports:USA On-Line .

It’s a product that is more than just forecast numbers. It also delivers cutting-edge insight regarding the current and expected changes in airline strategies and tactical market planning that airports need factor into future planning.

The above slide, along with the other insight presented at the IAFS Airports:USA session, are demonstrative examples of what the new, on-line program delivers. Key forecast trends will be a central part of the on-line program.

The above slide, along with the other insight presented at the IAFS Airports:USA session, are demonstrative examples of what the new, on-line program delivers. Key forecast trends will be a central part of the on-line program.

When there are dynamics that will affect an airport’s traffic levels, Airports:USA will flag it, and take the subscriber to a Dynamics page which will discuss the situation. It’s like having a forecast consultant with a couple of key strokes.

Available as an add-on feature for Aviation DataMiner subscribers, or as a stand-alone, Airports:USA will feature forecasts based on on-going updates in air service trends.

The New Norm – Capacity Volatility. With the “catch & release” route programs of some ULCCs, as well as new hub-term warning. This means that reliance on traditional metrics and methodologies to determine future traffic levels is simply not viable.

Over 140 of the nation’s airports are included, which comprise over 95% of all passenger traffic.

For more information on the new program, just click here and we’ll get you on the information list ASAP, and discuss how Airports:USA is the next generation in air service access planning.

And to explore our expertise in assisting clients in global projects, click here.

__________________