Toss Out Traditional Planning – It’s A New World

CCP-COVID: Re-Configuring The U.S. Airline Industry

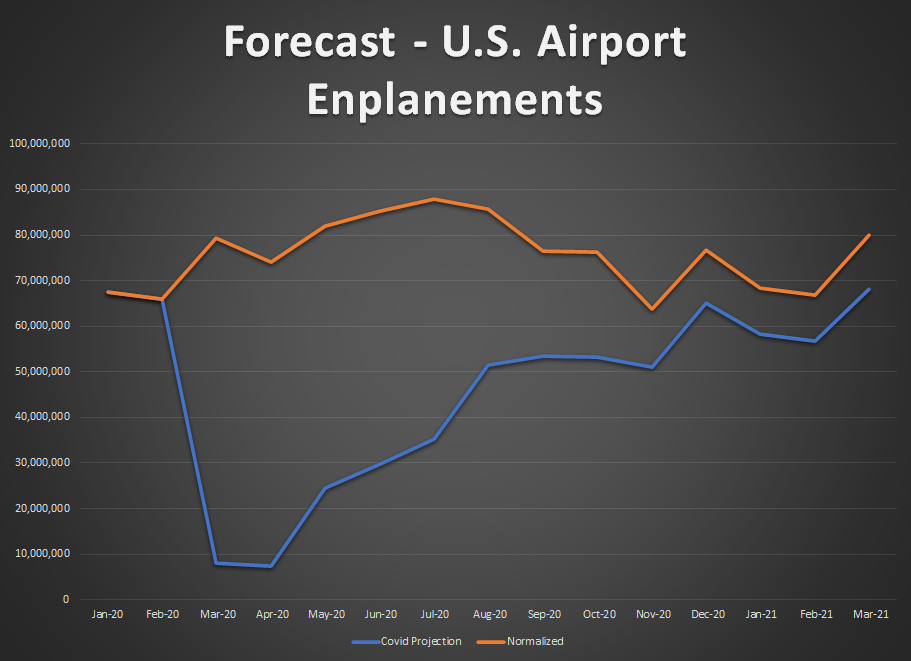

Boyd Group International’s Airports:USA® has accomplished an independent projection of the effects of the CCP-COVID pandemic on the U.S. air transportation industry.

Not pretty… But better than the rest of the globe, where entire fleets have been orphaned when their former operator goes out of business.

But it is still huge losses. Basic U.S. forecasts for the next 12 months indicate a fare revenue decline of at least $95 billion. Billion with a B. That’s just fares.

Total O&D loss for U.S. airports: 440 million. That’s a lot of lost airport revenue.

Foundational Requirement: Emerging From The Cave. Soon. The basic criteria of this projection are founded on a recovery starting in June, and gradually increasing to a stabilized situation by the end of the year 2020.

There are a range of assumptions blended into this forecast, and there are no guarantees. One key factor is that unless the economy starts to get reopened within the next two months, the airline industry is going to simply have to completely rethink entire operations. Entirely.

Unfortunately, “stabilized” is not the same as going back to 2019 levels.

New Fleets: Accelerated Opportunities. In particular, international traffic will have a smaller role, and it will affect the entire system. Historically, 32% of all U.S. enplanements have been directly or indirectly driven by international demand. “Direct” is to and from foreign destinations. “Indirect” are the domestic journeys that a portion of these passengers accomplish within the USA.

The picture is not all bleak. To be sure, a material part of this traffic will not return – the E.U. is badly mauled by the CCP pandemic, and leisure traffic will be badly deflated for the near term.

Trans-Atlantic traffic will return, but will be more diffused – good news for mid-size airports east of the Mississippi. As we have pointed out before, there will be fewer wide-body airliners – which mostly have to rely on hub-feed, and more new generation multi-mission narrow body airliners such as the A321XLR and A220. These will be a major part of restructured major airline fleets, on both sides of the Pond.

They will widen the air access for non-hubsite commercial centers – including international. E.U. airlines will be in need of additional feed for their connecting hubs, and these airliners will be the modality to access airports such as Albany, Norfolk, Cincinnati/Northern Kentucky, Columbus and several more.

China: Air Traffic Suicide. The Pacific will be where the real international changes will be seen. Shifting business and political trends will tend to enhance some demand to secondary points such as Vietnam, Malaysia, the Philippines, and Indonesia. Business investment is going to shift – big time – from China.

But these changes won’t anywhere make up for the plunge in U.S.-China traffic, which is headed directly into the air transportation ceramic fixture, and will not recover to anywhere near where it was in 2019.

In fact, changes in the Chinese economy, changes in business and industrial relationships, changes in CCP policies toward foreigners (not inconsequential), and diplomatic shenanigans around the globe, will cause China-international traffic to crater.

As for China-U.S. air traffic demand, it will drop like a baby grand out of the 8th floor window. Our BoydGroupChina projections point to 2021 traffic in the 400,000 O&D range – down from 8.2 million in 2019.

And it’s not temporary. China as a leisure destination – the majority share of the China-U.S. volume – has now been self-destructed by the CCP. There’s nothing like visiting a country where foreigners are now officially blamed for the pandemic (which is like John Gotti complaining that the police caused organized crime) and often accosted on the streets and prohibited from entering restaurants, or where hotels don’t want the business. Things there have changed in the last year. U.S. carriers should be very careful in planning their future China strategies.

We’ll be completing the China-U.S. revised forecast this week and will post the highlights at www.BoydGroupChina.com

In the meantime, Boyd Group International is accomplishing CCP-COVID forecasts for individual client airports, focused on the specific and unique characteristics of each… hard and direct data which can deliver perspectives on the future ahead.

Give us a call or hit the contact tab, and we’ll deliver a view of the future – clear and unvarnished.

FROM ALL OF US AT BOYD GROUP INTERNATIONAL WISH YOU A GREAT, PROSPEROUS AND HEALTHY WEEK AHEAD.